Plant Project Report" width="" height="" />

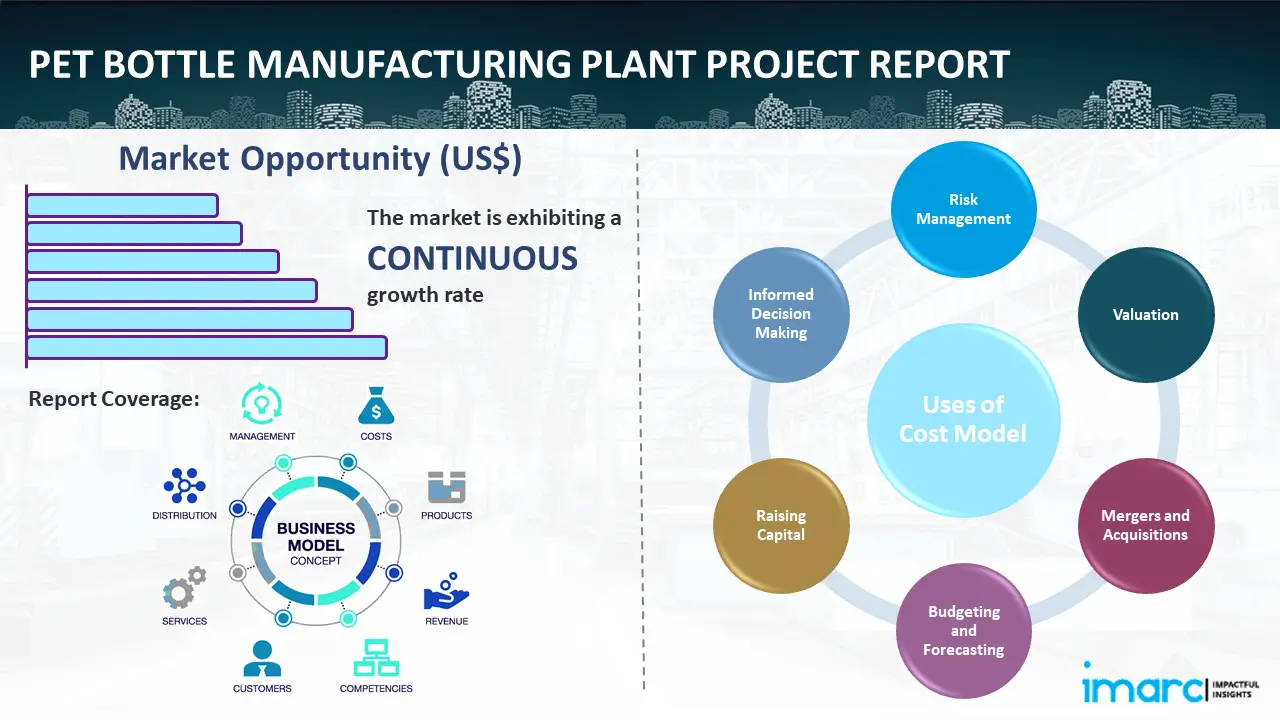

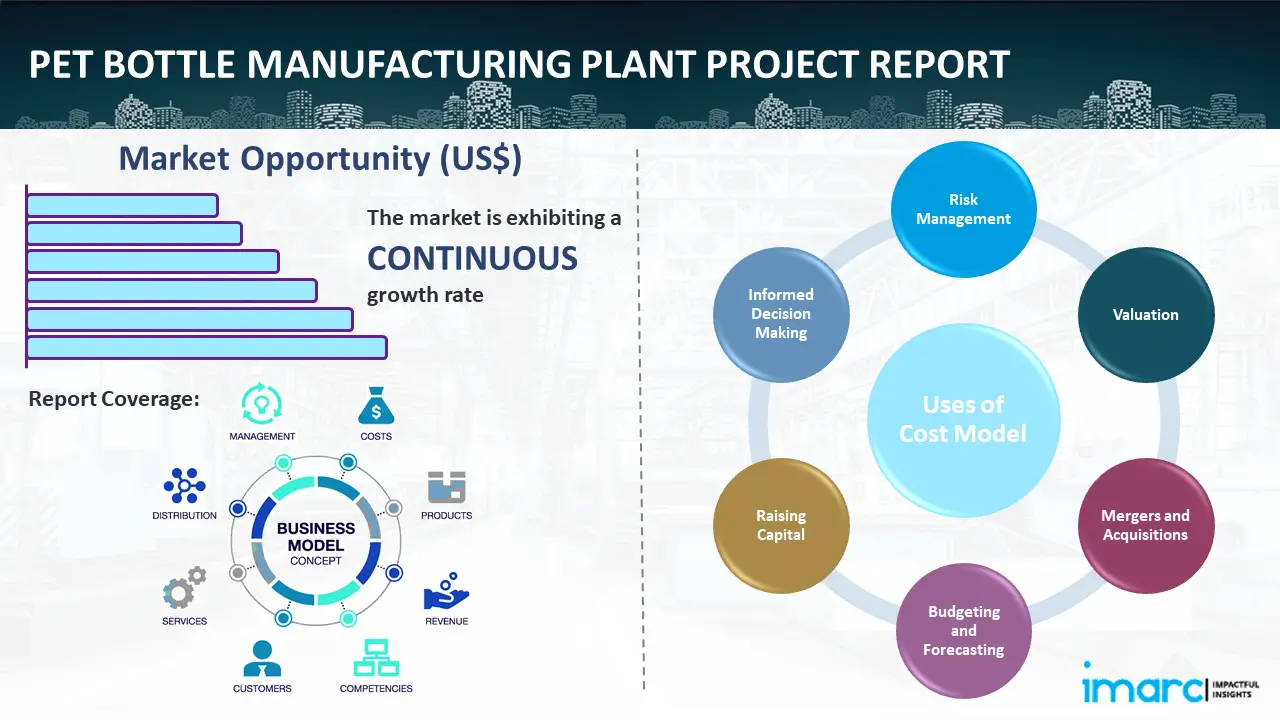

Plant Project Report" width="" height="" />IMARC Group’s report, titled “PET Bottle Manufacturing Plant Project Report 2024: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue,” provides a complete roadmap for setting up a PET bottle manufacturing plant. It covers a comprehensive market overview to micro-level information such as unit operations involved, raw material requirements, utility requirements, infrastructure requirements, machinery and technology requirements, manpower requirements, packaging requirements, transportation requirements, etc. The PET bottle project report provides detailed insights into project economics, including capital investments, project funding, operating expenses, income and expenditure projections, fixed costs vs. variable costs, direct and indirect costs, expected ROI and net present value (NPV), profit and loss account, financial analysis, etc.

Plant Project Report" width="" height="" />

Plant Project Report" width="" height="" />

This market is being driven by increased interest in sustainable development. UNESDA emphasizes that of the total application rPET, 48% in 2022 was used in bottles. In 2022, the recycling rate of beverage bottles was 24%, which is 7% more than in 2020. The collection rate of PET worldwide was 60%, significantly above 45% in 2020. The recycling rate of only PET beverage bottles that are sorted for recycling is 75%, which is 14% more compared to 2020. At the same time, governments and environmental organizations around the world introduce stringent regulations for packaging materials. They encourage manufacturers to use recycling and other sustainable methods and practices, borrowing ideas from Europe. Another fundamental aspect that promotes the international market is the convenience provided by these bottles.

Today, 70% of soft drinks are in PET bottles; the remaining 30% are in cartons, aluminium cans, and glass bottles. The minimum weight of these bottles reduces transportation costs and eliminates environmental damage from transportation. In some industries, transport costs are high. Therefore, the value of weight reduction is also expensive. In the US, for example, of the total volume of single-serve beverage packaging for packages of less than 1 liter, PET bottles accounted for 44.7%, aluminum cans 39%, glass bottles 11%, and HDPE 3.4 percent. Bottles withstand impacts and exert pressure, thereby at the same time ensuring the safety and good quality of products in industries such as beverages, pharmaceuticals, and personal care.

Demand for Premium Packaging

The rise in demand for premium packaging is another major trend driving the PET bottle market. According to reports revealed in Euromonitor International, London, England, PET bottle covering 67% of market data in the beverage industry includes water, carbonated soft drinks, energy drinks, tea and coffee. Enhanced performance-oriented PET bottles are being designed with appealing aesthetics and high-quality features. The functionality has been gaining popularity among premium beverage, and cosmetics and personal care customers. According to IMARC Group, the global PET bottle market size is expected to reach US$ 60.3 Billion by 2032, exhibiting a growth rate of 3.3% during 2024-2032. Consumers demand protection and prioritize with the brand due to the addition of experience-oriented packaging, making PET necessary in the manufacturing of innovative packages.

Advancement in Manufacturing Technologies

Technological advancements are another significant trend propelling the global market. Manufacturers are enhancing their production methods to increase efficiency. Technologies like plasma coating improve the barrier properties of PET bottles, extending the shelf life of sensitive products such as juices and dairy. In 2016, approximately 485 billion PET bottles were produced, and this number is expected to reach 583.3 billion by 2021. Furthermore, developments in blow molding technology allow for quicker production and more precise, complex bottle designs. These advancements not only reduce production costs but also enable the creation of innovative bottle shapes and sizes, meeting consumer and industry demands. Consequently, embracing innovation is crucial for manufacturers aiming to produce more sustainable products and align with global sustainability efforts.

The market is also being driven by increasing investments and capacity expansions:

The following aspects have been covered in the PET bottle manufacturing plant report:

The report provides insights into the landscape of the PET bottle industry at the global level. The report also provides a segment-wise and region-wise breakup of the global PET bottle industry. Additionally, it also provides the price analysis of feedstocks used in the manufacturing of PET bottle, along with the industry profit margins.

The report also provides detailed information related to the PET bottle manufacturing process flow and various unit operations involved in a manufacturing plant. Furthermore, information related to mass balance and raw material requirements has also been provided in the report with a list of necessary quality assurance criteria and technical tests.

The report provides a detailed location analysis covering insights into the land location, selection criteria, location significance, environmental impact, expenditure, and other PET bottle manufacturing plant costs. Additionally, the report provides information related to plant layout and factors influencing the same. Furthermore, other requirements and expenditures related to machinery, raw materials, packaging, transportation, utilities, and human resources have also been covered in the report.

Capital Expenditure (CapEx) and Operational Expenditure (OpEx) Analysis:

.webp) Plant Project Report" width="" height="" />

Plant Project Report" width="" height="" />

The report also covers a detailed analysis of the project economics for setting up a PET bottle manufacturing plant. This includes the analysis and detailed understanding of capital expenditure (CapEx), operating expenditure (OpEx), income projections, taxation, depreciation, liquidity analysis, profitability analysis, payback period, NPV, uncertainty analysis, and sensitivity analysis. Furthermore, the report also provides a detailed analysis of the regulatory procedures and approvals, information related to financial assistance, along with a comprehensive list of certifications required for setting up a PET bottle manufacturing plant.

Profitability Analysis:

| Particulars | Unit | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

|---|---|---|---|---|---|---|

| Total Income | US$ | XX | XX | XX | XX | XX |

| Total Expenditure | US$ | XX | XX | XX | XX | XX |

| Gross Profit | US$ | XX | XX | XX | XX | XX |

| Gross Margin | % | XX | XX | XX | XX | XX |

| Net Profit | US$ | XX | XX | XX | XX | XX |

| Net Margin | % | XX | XX | XX | XX | XX |

| Report Features | Details |

|---|---|

| Product Name | PET Bottle |

| Report Coverage | Detailed Process Flow: Unit Operations Involved, Quality Assurance Criteria, Technical Tests, Mass Balance, and Raw Material Requirements |

Land, Location and Site Development: Selection Criteria and Significance, Location Analysis, Project Planning and Phasing of Development, Environmental Impact, Land Requirement and Costs

Plant Layout: Importance and Essentials, Layout, Factors Influencing Layout

Plant Machinery: Machinery Requirements, Machinery Costs, Machinery Suppliers (Provided on Request)

Raw Materials: Raw Material Requirements, Raw Material Details and Procurement, Raw Material Costs, Raw Material Suppliers (Provided on Request)

Packaging: Packaging Requirements, Packaging Material Details and Procurement, Packaging Costs, Packaging Material Suppliers (Provided on Request)

Other Requirements and Costs: Transportation Requirements and Costs, Utility Requirements and Costs, Energy Requirements and Costs, Water Requirements and Costs, Human Resource Requirements and Costs

Project Economics: Capital Costs, Techno-Economic Parameters, Income Projections, Expenditure Projections, Product Pricing and Margins, Taxation, Depreciation

Financial Analysis: Liquidity Analysis, Profitability Analysis, Payback Period, Net Present Value, Internal Rate of Return, Profit and Loss Account, Uncertainty Analysis, Sensitivity Analysis, Economic Analysis

While we have aimed to create an all-encompassing PET bottle plant project report, we acknowledge that individual stakeholders may have unique demands. Thus, we offer customized report options that cater to your specific requirements. Our consultants are available to discuss your business requirements, and we can tailor the report's scope accordingly. Some of the common customizations that we are frequently requested to make by our clients include: