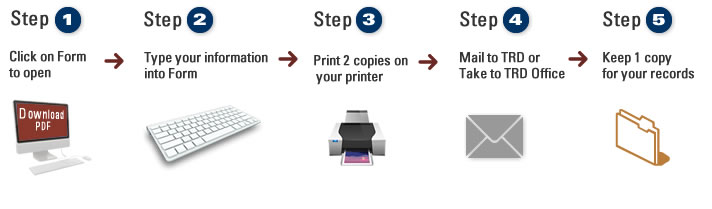

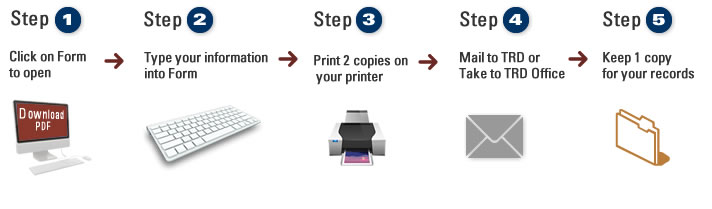

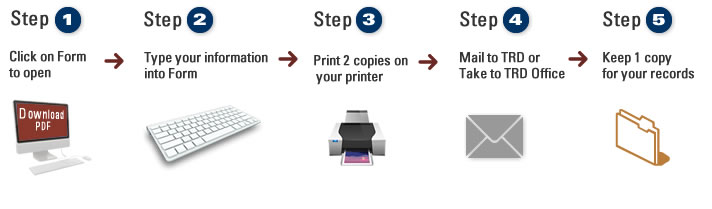

Fill, Print & Go

When you use our Print, Fill and Go Forms, you can walk into any of our District Offices with a completed tax form in your hands. The feature saves you the time you would otherwise spend looking for the form, printing it, filling it out in ink, and risking some difficulty on the part of the TRD employee if any of the ink isn’t clear enough to be read easily. You can use your computer keyboard to type your information directly onto the form you’ve chosen and speed up your time at the district office counter. Just follow the step-by-step instructions above.

Frequently Asked Questions

How should I enter information into the form?

Using your computer keyboard type the information directly onto the screen.

Should I include dashes, dollar signs, commas or texts with the data entered?

You can include dashes, dollar signs and commas in your entries.

Can I make changes after all the information has been entered on the form?

Yes, you can still go in and make changes after entering the information.

What do I do if I’ve entered the wrong information?

If you make an error, simply go back, delete the incorrect information and replace it with the correct information.

Should I save a copy of my completed form before sending or taking it to you?

You cannot save a copy of the completed form on your computer, but you can print it for your records.

What do I do with the completed form at the TRD Office?

When you get to the window or counter with your form, please let the employee know that you have already completed a Fill, Print and Go Form. He or she will give you further instructions if any are needed.

Forms

RPD-41308 (A) | Fuel Retailer Schedule of Gasoline Purchases | Download PDF

RPD-41308 (B) | Fuel Retailer Schedule of Gasoline Purchases | Download PDF

PTD-0066 | 2011 65 and Older or Disabled | Download PDF

ACD-31110 | Financial Information Statement (Personal) | Download PDF

ACD-31111 | Financial Information Statement (Business) | Download PDF

ACD-31102 | Tax Information Authorization – Tax Disclosure | Download PDF

ACD-31015 | Business Tax Registration Application and Update Form | Download PDF

ACD-31094 | Formal Protest | Download PDF

General Fund revenue to increase by 2.8% for FY26

New collection letters provide options for taxpayers

New Mexico to join IRS Direct File program for federal taxes

Gov. Lujan Grisham reminds New Mexicans about Tax-Free Weekend

Tax and Rev again expands disaster filing extensions

MVD checks for drug, alcohol violations on commercial licenses

Be wary of unclaimed property solicitations

ACH payments now available for Corporate Income Tax

Tax and Rev expands disaster filing extensions

Ruidoso MVD to reopen in temporary space

Smokey Bear Fire Prevention plates now available from MVD

Tax & Rev recognized for oil and gas compliance tool

Delinquent property tax auctions scheduled in three counties

Some taxpayers receive incorrect penalty, interest letters

Department schedules hearing on property tax exemption rules

Tax and Rev issues guidance on Hermit’s Peak tax credit

Delinquent property tax auction scheduled in Valencia County

MVD expands self-service kiosk program

MVD to launch new self-service kiosks

Taxation and Revenue urges taxpayer caution

MVD celebrates Donate Life Month

Tax filing deadline less than a month away

Governor signs tax bill that will save New Mexicans $231 million

New Mexico’s standard turquoise license plate judged No. 1 in the U.S.

New Child Income Tax Credit available to taxpayers for the first time

Embezzlement defendant accepts plea agreement

Report: New Mexico in top tier for tax administration

Department finalizes new Gross Receipts Tax regulations

General Fund revenues expected to continue growth

Delinquent property tax auctions scheduled for December

More than $6 million in 2022 rebates available in unclaimed property

State re-issues proposal for Los Alamos site to consolidate offices

Taxation & Revenue Releases 2023 Tax Expenditure Report

Tax and Rev brings cannabis businesses into tax compliance

MVD adds flexibility to appointment system

Taxation and Revenue urges taxpayer caution

Department schedules hearings for new regulations

Credit card fees to increase for some MVD transactions

Delinquent property tax auctions scheduled

New scam targets property owners with delinquent tax notice

State agencies looking for Los Alamos site to consolidate offices

Delinquent property tax auctions scheduled in four counties

Property tax auctions scheduled in three counties

Codes no longer required for some Gross Receipts Tax deductions

Gov. Lujan Grisham reminds New Mexicans about the upcoming Tax-Free Weekend

Secretary Stephanie Schardin Clarke elected to chair MTC

MVD lifts suspensions for failure to pay or appear in court

State portion of Gross Receipts Tax drops to 4.875%

New Gross Receipts Tax Filer’s Kit available

Santiago Chavez to lead Audit and Compliance Division

Delinquent property tax auctions scheduled

Governor announces $500 rebates to go out in mid-June

Tax returns for 2022 are due Tuesday

Delinquent property tax auctions scheduled

Governor Lujan Grisham approves $500 rebates

Taxation and Revenue announces leadership appointments

Taxation and Revenue Secretary Stephanie Schardin Clarke confirmed for second term

Delinquent property tax auctions scheduled

NM rebates not subject to federal taxation, IRS says

New Mexico awaiting guidance from IRS on 2022 rebates

Department clarifies instructions for pass-through entities

Taxation and Revenue adds fraud-fighting tools

Governor announces plan to deliver economic relief to New Mexicans

Tax filing season opens Monday, January 23

Taxation and Revenue audit findings continue to improve

Income tax rebates were top tax expenditures in 2022

Taxation and Revenue Department budget takes aim at improving service to constituents

New paper Gross Receipts Tax Filer’s Kits available on request

General Fund revenues expected to remain strong

Delinquent property tax auction scheduled in Luna County

Real ID deadline extended again

$10 million in financial assistance funds for New Mexico low income households

Delinquent property tax auctions scheduled

New publication provides tax guidance on lodging, vacation rentals

Applications for economic relief payments open Monday, September 26

Owners can now reclaim unclaimed property online

Delinquent property tax auctions scheduled

Department publishes proposed regulations for digital advertising

Updated law ensures parity for all New Mexican owned businesses

New Mexico taxpayers in disaster areas gain more time to file taxes

Incorrect Gross Receipts Tax rate published for Gallup

Taxation and Revenue Department adds more fairness to New Mexico’s tax system, expediting the ‘innocent spouse tax relief’ application process

Final round of household relief approved by Gov. Michelle Lujan Grisham goes to taxpayers this week

Back-to-School tax holiday is this weekend

Business reminder: First Gross Receipts Tax cut in 40 years now in effect

Second round of rebates underway

Gov. Lujan Grisham exempts Social Security income from taxes, delivers first Gross Receipts Tax reduction in 40 years

Taxation and Revenue wins national award for Gross Receipts Tax technology

Department publishes electronic filing and payment mandates

First month of cannabis sales generate $2.4 million in Excise Tax

New Mexicans in disaster areas have until August 31 to file taxes

Delinquent property tax auctions scheduled in seven counties

State, pueblos enter cooperative agreements on cannabis

Governor: Financial relief heading to New Mexicans this week

San Miguel County property tax deadline extended

First Cannabis Excise Tax payments due this month

Mora County property tax deadline extended

Applications for economic relief payments for non-filers open May 2

Income tax returns due Monday

MVD celebrates Donate Life Month

Department publishes draft rules on electronic filing, payments

New Mexico vehicle titles can now be transferred online

Department issues $248 million in refunds, prepares to issue rebates

Taxpayers to receive rebates in July

MVD Direct self-service kiosk now available on Albuquerque’s West Side

Albuquerque dentist agrees to plea deal on tax fraud charges

New entry-level commercial driver’s license regulations

Automated tools now available for reporting GRT

Tax season is open

Vendor reissuing some driver’s licenses

Former employee pleads guilty to fraud, identity theft, money laundering

MVD opens new self-service kiosk

Portal update allows taxpayers to make more account changes

Secretary Stephanie Schardin Clarke named to FTA Board

Tax Expenditure Report details cost of credits, deductions

Small Business Saturday is November 27

Tax Workshops open for registration

MVD to keep appointment model, expanded online services

Delinquent property tax auctions scheduled

Reminder: GRT, Compensating Tax subject to destination sourcing

Tax Workshops open for registration

Delinquent property tax auctions scheduled this month

Department launches new public records portal

Delinquent property tax auctions resume in three counties

Taxation and Revenue Department takes aim at vacancies

Tax Practitioner Advisory Committee meets Sept. 9

State secures agreement on resolving 2018 local government lawsuit - Plaintiffs would share $50 million in Gross Receipts Tax distributions case

MVD upgrades self-service portal - MyMVD Online Services will be unavailable Sept. 3-5

MVD releases new practice driving test

Hearing scheduled on draft regulations for Gross Receipts Tax on services

Back-to-School tax holiday is this weekend

Vehicle titles to be issued by mail

MVD warns New Mexicans against scam

Updated publication provides guidance on Gross Receipts Tax changes

New business tax filing system launches in July

New Gross Receipts Tax rules take effect July 1

MVD ends automatic issuance of temporary license extensions

Department issues filing instructions for business tax transition

Applications open June 14 for $5 Million in economic relief

Taxation and Revenue offices reopen for tax appointments on June 1

Tax Practitioner Advisory Committee to meet June 3

Tax Policy Advisory Committee to meet May 13

Road tests allowed only in counties designated ‘Green’ or ‘Turquoise’

MVD celebrates National Donate Life Month

Payment deadlines approaching for 2020 tax relief

Hearing scheduled April 29 on new Gross Receipts Tax regulations

Department begins issuing special $600 rebates

Appointments available at MVD due to expanded capacity

Personal Income Tax deadline extended until May 17

Former Department employee indicted on federal charges

Department issues guidance on $600 rebates, restaurant GRT relief

Draft forms, instructions for GRT and other business taxes now available

Tips for Taxpayers

Guidance on $600 Income Tax Rebates

MVD launches new appointment system, expands in-person operations

Alamogordo man charged with embezzlement, tax fraud

Department begins issuing 2020 income tax refunds

Attorney General, Taxation and Revenue urge taxpayers to be cautious

Changes Coming to Combined Reporting System

Modified enforcement extended through August

July new business workshop to be presented online

New multi-year tax forms available

Hearing scheduled on new rules for New Mexico driver’s licenses

Tax Policy Advisory Committee meets Wednesday

Delivered groceries may not be taxable

TRD Audit and Compliance Division to start outbound calling

Online Services

Find an Online Service to Serve Your Needs

1200 South St. Francis Drive

Santa Fe, NM 87505

1-866-285-2996

Manage Cookie Consent

This site uses cookies to collect site usage data and provide social media services. If you choose to contact us via our contact form, the information you enter will be kept unless you request it to be discarded.

Functional Functional Always active

The technical storage or access is strictly necessary for the legitimate purpose of enabling the use of a specific service explicitly requested by the subscriber or user, or for the sole purpose of carrying out the transmission of a communication over an electronic communications network.

Preferences Preferences

The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested by the subscriber or user.

Statistics Statistics

The technical storage or access that is used exclusively for statistical purposes. The technical storage or access that is used exclusively for anonymous statistical purposes. Without a subpoena, voluntary compliance on the part of your Internet Service Provider, or additional records from a third party, information stored or retrieved for this purpose alone cannot usually be used to identify you.

Marketing Marketing

The technical storage or access is required to create user profiles to send advertising, or to track the user on a website or across several websites for similar marketing purposes.